Indian Domestic Civil Aviation: Economy and Players

A brief study about the Indian Aviation Industry.

Aircraft in Indian skies date back to February 1911, when a biplane shipped from England was brought to an exhibition in Allahabad for demonstration.

Today with more than 700 aircraft and 103 airports Indian aviation is the world’s third-largest civil aviation market with multiple national and international companies trying to capitalize on the huge demand. Some of the major players in Indian civil aviation are listed below in the table.

| Logo | Name | Origin | Number of Aircrafts | Market Share (in %) | Revenue (in Crores) | Debt (in Crores) |

| Indigo | Gurugram, Haryana | 278 | 48.2 | ₹15,677.6 | ₹43,051 |

| SpiceJet | Gurugram, Haryana | 91 | 15.6 | ₹6,072.55 | ₹11,367 |

| Air India | New Delhi | 172 | 10.9 | ₹26,430.59 | ₹61,562 |

| Go First (Erstwhile Go Air) | Mumbai | 57 | 10.8 | ₹4,553 | ₹16,419.73 |

| Air Asia | Sepang, Malaysia | 28 | 6.7 | ₹1,532 | ₹11,491 |

| Vistara | Gurugram, Haryana | 47 | 5.8 | ₹1,612 | ₹9,070.62 |

But the Indian skies are not so easy to capitalize on, although many companies have made remarkable growth here, there are a select few who struggled and ultimately ceased operations, this includes King Fisher Airlines and Jet Airways. Spice Jet barely recovered from huge debts and Air India owned by the Govt. of India under huge debts had to be sold off to TATA Group is one of the government’s privatization drives.

Studying the case of Kingfisher Airlines, a company promoted by Vijay Mallya of United Breweries, which aggressively priced tickets 20-30% below its then competitors Jet Airways and Sahara Airlines, but soon it got caught up in the crosswinds of competition by Air India Express and failed in trying to break the monopoly of Etihad and Emirates in international skies post-acquisition of Air Deccan.

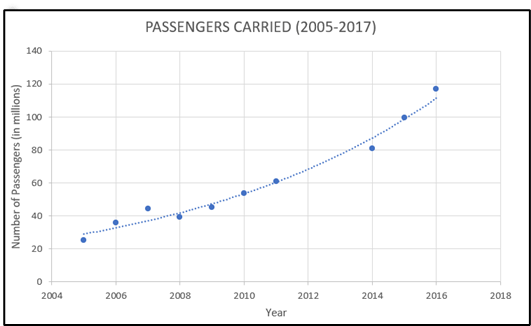

Looking at the available annual data of the number of passengers using domestic flight services, it is evident that the gap between ticket prices and the price people are willing to pay for the advantages offered by air travel is reducing. Which further proves why a company like Indigo which has its USP of being a low-cost domestic airline has the largest market share. The reason for this sharp rise in customer base can also be credited to the increase in the working-class population of India, rising per capita income of people making air travel affordable, growing confidence in Airways as a fast and safe way for transportation.

Indian magnate Rakesh Jhunjhunwala backed Akasa Air is set to commence operations in mid-2022. This airline is proposed to be run by former Jet Airways CEO Vinay Dube. Akasa Air has projected to acquire 72 aircraft in the next 4 years. These decisions indicate there would be a continuation in the currently exponential growth in the number of passengers accessing flights for travel.

Looking at the prospects of Indian civil aviation, it is evident that the government policies are in line for more and more capital infusion into the system since it allows 100% Foreign Direct Investments (FDIs). Some of the recent government policies to boost this sector are:

- National Civil Aviation Policy (NCAP), 2016: It promotes ease of doing business, deregulation, simplified procedures, and e-governance.

Regional Connectivity Scheme: Under the scheme, airfare for a one-hour journey of 500 km has been capped at INR 2,500, as an all-inclusive charge.

National Civil Aviation Policy (NCAP), 2020: The Goods and Services Tax for Maintenance, Repair, and Overhaul (MRO) services rendered locally was reduced from 18% to 5%. This has been an extremely crucial policy amendment as it will encourage global participation in the Indian aviation sector by allowing foreign MRO operators to subcontract MRO work to Indian entities without any extra tax liability.

In the pandemic, the aviation sector faced barriers such as discontinued flights, limited operation, less workforce, etc. Overall, the aviation industry contributes $35 billion annually to India’s GDP for the past few years. The critical assets created by the sector also account for the humongous employability it provides which is roughly around 1.7 million in the country and is estimated to be increased to 4 million by 2035.

India is one of the fastest-growing aviation markets in the world and the main reason for this is demographics. Despite these favourable conditions, India’s aviation industry is largely untapped.

The factors which could be credited to drive its industrial growth might be ease of doing business (Over the last five years India has risen from 132 to 100 on the World Bank’s Ease of Doing Business survey) and travel & tourism (India has risen from 52nd place (2015) to 40th (2017) place in the 2017 World Economic Forum’s Travel and Tourism Competitiveness Index).

The Govt. of India’s move of privatization of PSUs also possesses some hopes of diversification of this industry. Airlines, especially in India, should emphasize more on the implementation of customer relationship management, total quality management and collect feedback from customers after every journey and manage these responses effectively. This will not only help improve weaknesses in the operations of these aviation companies but also help improve customer loyalty and brand image through effective and innovative solutions.

- Researched and Written by Shine Priyan and Sameer Ranjan, Technical Members, SAE Phoenix Aero.